transfer car loan to another person singapore

The EIR of your loan will depend on the annual interest rate or bank advertised nominal interest. Seeking a new lender will end up costing you more but the new borrower will likely see more benefits.

7 Issues To Consider Before Being A Loan Guarantor In Singapore Singaporelegaladvice Com

The IC of the person in charge of handling the deceaseds matters.

. To be able to transfer your car loan to somebody else you need to surrender the ownership of the vehicle to them as well. Conduct online vehicle transfer. If the lender is not in the area contact them on the phone.

Banks may let you do this provided you fulfil certain conditions. The most straightforward way is to pay up the remaining amount of the loan in. You should be at least 21 years old at the time of applying for the loan.

Otherwise the car will remain in your husbands name and you will simply be making the payments. You are transferring a diplomatic vehicle. If you are intending to sell your car to your friend there are a couple of solutions you can do it.

Transaction Pins TPINs will no longer be necessary from 26 November 2018. Transferring an auto loan is a big deal as it lays responsibility on somebody who may never have had an interest in owning the car. UOB Hire Purchase Car Loan - Used Car.

SingSaver compares the best Personal Loans in Singapore that range from 1-year to 7-year tenures. While you could refinance your car into someone elses name there are easier ways to get rid. Motor dealers are able to offer assistance in the de-registration and disposal process.

You are buying a Light Goods Vehicle LGV as a hawker or farmer. Driving it may expose you to a fine of up to 1000 or an imprisonment term of 3 months. You must visit the nearest RTO office for the same.

It is mentioned in the loan document whether it is possible to transfer your loan to another person. The deceaseds original death certificate. The only way to take over the car loan in your name is to have it done legally.

The eligibility criteria for transferring your auto loan balance may vary from lender to lender. Modify with your existing lender or seek a new lender. The most common criteria include.

When the registration and title are transferred to a new owner the lender needs to be notified. You may apply for transfer of your vehicle at the LTA Customer Service Centre for the following cases only. There are two primary ways to transfer a car loan to another individual.

At JPJ youll need to have the following things. The most preferred option is to close your loan account by settling the loan in advance and then selling the car. In any case youre looking to transfer ownership of your vehicle to another driver who will love it just as you do.

Heres everything you need to know about transferring ownership of your car in Singapore. The Short and Sad of It. First you will have to submit the bank documents showing the details of new borrower to the RTO office.

The short answer which you are not going to like. Eligibility criteria for car loan balance transfer. Bring your husband with you.

Nope you are unable to do any transfer of the car loan to any individual. Interest paid over the next 7 years - 808121. In any case if you do opt to transfer your loan to another person you will need to follow the procedure outlined below.

Keep the following things in mind while transferring the car loan to another person. Every time someone is added or removed from a car loan the title changes to reflect this. Modifying with your existing lender will present the least penalties to you but it may not be the best deal for the new borrower.

But if you are unable to repay the loan there is an option to transfer the loan to the next person. Check the current loan agreement details Before thinking of transferring the loan to another person you must ensure that you have gone through the details of your loan documents. You should be 60 years or lesser at the end of your loan tenure.

Interest per year - 115446. Loan amount - 5247542. This saves you 1034 a month or 12408 a year.

By law the person who signed an auto loan is the owner of the car. First get the car inspected by Puspakom and then head to JPJ. To better align with Singapores vision of being a Smart Nation the Land Transport Authority LTA will be doing away with Transactions Pins TPINs for the following.

Find out how you can get a great deal on car loans in Singapore including vehicle finance options which are paid in instalments to lenders. The effective interest rate EIR you can enjoy from the loans on our site range from 70 pa. You must make an appointment to transfer the ownership of vehicle at the LTA Customer Service Centre if.

Therefore the total amount to be refinanced with interest will be 5247542 808121 or 6055663. Go Through Your Loan Documents. Car loan transfer not only requires the transfer of loan documents but also the change in car registration.

To avoid this you wish to tow or transport the car in order to dispose it. JPJ K3A form this is different from the K3 form which is for voluntary transfers. Find a Transfer Partner.

If a loan transfer is done on behalf of the original debtor one should only agree to take the loan if they are a spouse or very close family member not a boyfriend or girlfriend fiancee or friend. SINGAPORE Unless you can buy a car with cash outright youll have to beg borrow or steal. Heres a step-by-step guide on how to transfer car ownership and deregister your vehicle via the LTA portal.

Most people being generally law-abiding opt for the middle option and borrow to buy one. In order to transfer your Car Loan to someone else you will need to cede ownership of the vehicle to this person. Toggle menu toggle menu path dM526178 313114L447476 606733L741095 685435L819797 391816L526178 313114Z fillF9C32D.

At LTA Customer Service Centre. If you want to transfer a car loan to another person you also have to transfer ownership. This brings the monthly instalment of 6055663 over 84 months to 72091.

Visit the dealer or bank where your husbands car loan is from. You may also be disqualified from driving for at least a year. Buying a car in Singapore usually requires financing but the process of getting a car loan doesnt have to be an intimidating one.

Very Flexible A Lot Of Benefits Are Offered By Car Insurance Companies For An Additional Fee L Car Insurance Auto Insurance Companies Auto Insurance Quotes

Small Stand At Sibos 2015 Trade Show Singapore This Is Simply Logo Blended Structure With Welcom Exhibition Stall Design Exhibition Booth Design Booth Design

Writing An Income Verification Letter With Sample Loans For Bad Credit Same Day Loans Payday Loans

Transferring Your Car Ownership In Singapore A Complete Guide Singsaver

Transferring Your Car Ownership In Singapore A Complete Guide Singsaver

We Will Help You To Finance Your Dream Car Http Www Rupeeboss Com Car Loan Dream Cars Car Loans Business Capital

Marina Bay Hotel In Singapore Marina Bay Travel Bay

Prepayment Conditions For Car Loans Bankbazaar Com

My Holiday Essay In German In 2021 Prezi Presentation Essay Coordinate Grid

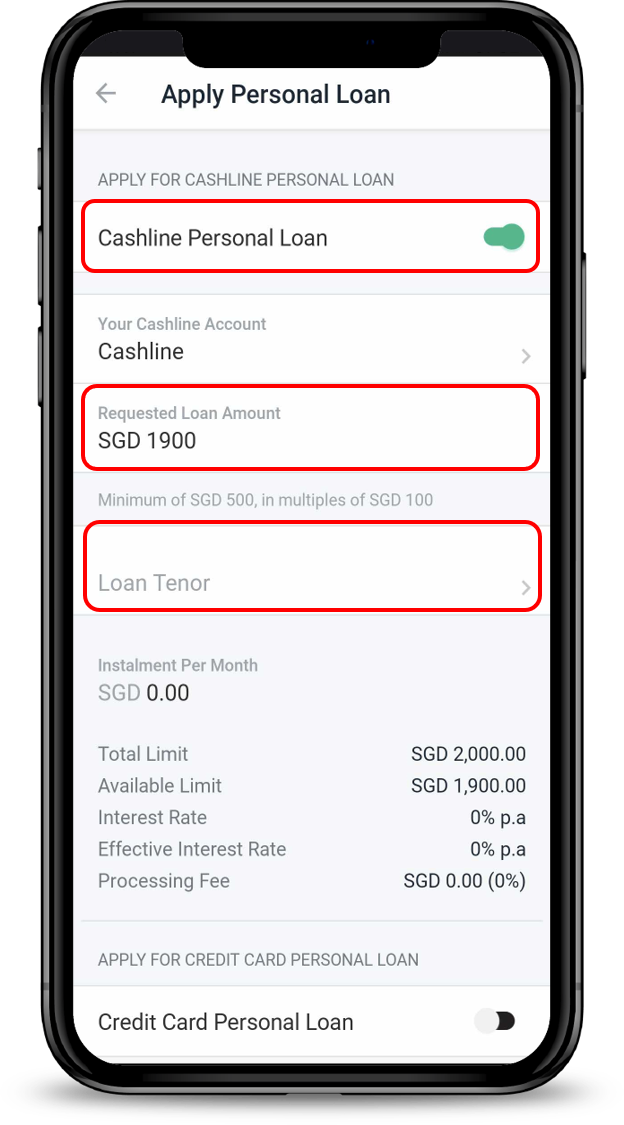

Apply For Posb Personal Loan Posb Singapore

Pay Off Debts Faster Using These Helpful Steps Usaa Budgeting Money Debt Payoff Pay Debt

Company Loans To Directors Shareholders In Singapore Singaporelegaladvice Com

Trading In A Car With A Loan Everything You Need To Know

Ocbc Car Loan Singapore Auto Finance Electric Petrol

Pin By Sono Slough On Continuity Seo Accelerator Passive Income Singapore Money Transfer

Six Steps Of Buying A Used Car By Otua Sell Used Car Car Buying Car Dealership